- Agency

Contixs – Business Consulting HTML Template

$17.00Original price was: $17.00.$3.99Current price is: $3.99. Add to cart Sale!

Sale!$17.00Original price was: $17.00.$3.99Current price is: $3.99.Add to cartVersion Latest Type Theme Released Date June 26, 2020 Quick View - Adobe Photoshop

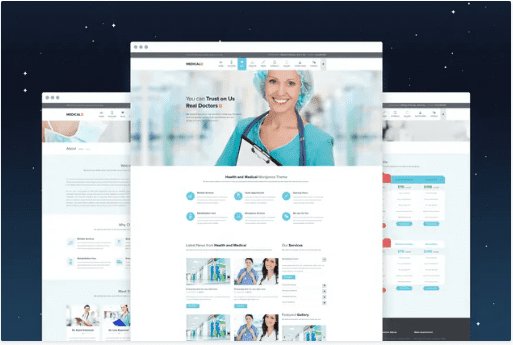

MedicalPress – Health and Medical PSD Template

$59.00Original price was: $59.00.$3.49Current price is: $3.49. Add to cart Sale!

Sale!$59.00Original price was: $59.00.$3.49Current price is: $3.49.Add to cartVersion Latest Developer Name Envato Type Template Demo Link https://envato.com/ Released Date July 25, 2020 Licence Type GPL Quick View - Adobe Photoshop

Crater – Business & Financial PSD Template

$43.00Original price was: $43.00.$3.49Current price is: $3.49. Add to cart Sale!

Sale!$43.00Original price was: $43.00.$3.49Current price is: $3.49.Add to cartVersion Latest Type Theme Released Date July 17, 2020 Quick View - Adobe Photoshop

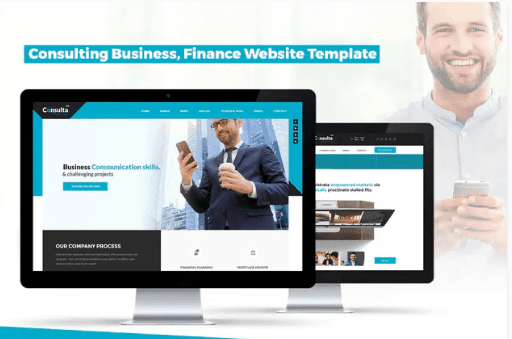

Consulting Business, Finance Website Template

$43.00Original price was: $43.00.$3.49Current price is: $3.49. Add to cart Sale!

Sale!$43.00Original price was: $43.00.$3.49Current price is: $3.49.Add to cartVersion Latest Type Template Released Date July 18, 2020 Quick View - Adobe Photoshop

Medicon – Health Care PSD Template

$59.00Original price was: $59.00.$3.49Current price is: $3.49. Add to cart Sale!

Sale!$59.00Original price was: $59.00.$3.49Current price is: $3.49.Add to cartVersion Latest Type Template Released Date July 18, 2020 Quick View - Adobe Photoshop

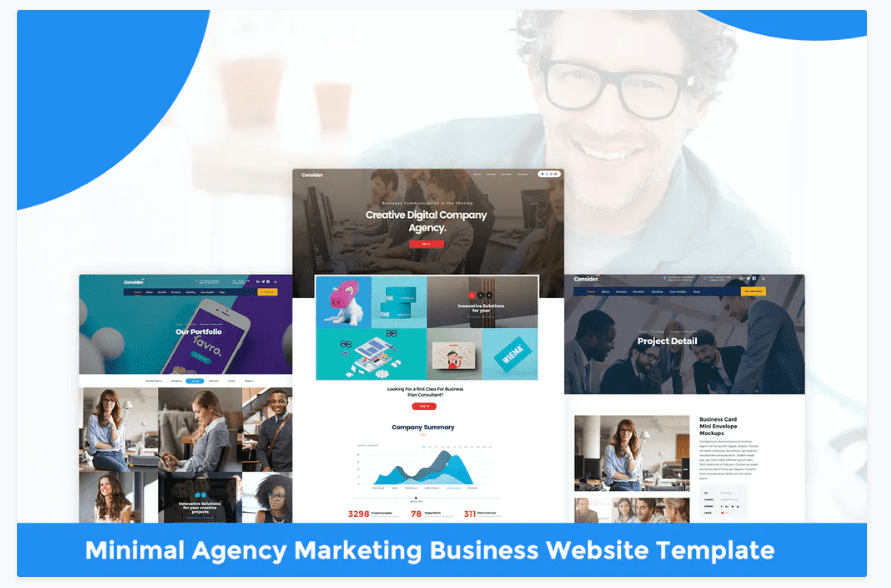

Minimal Agency Marketing Business Website Template

$59.00Original price was: $59.00.$3.49Current price is: $3.49. Add to cart Sale!

Sale!$59.00Original price was: $59.00.$3.49Current price is: $3.49.Add to cartVersion Latest Type Template Released Date July 18, 2020 Quick View - Adobe Photoshop

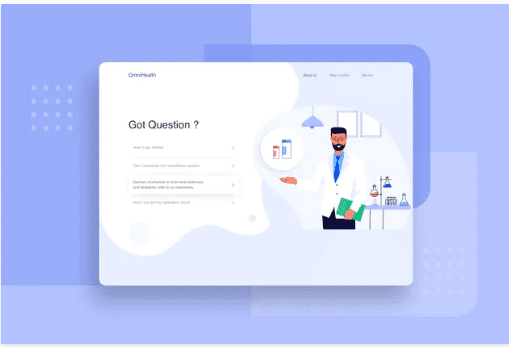

Doctor medicine composed successfuly website

$43.00Original price was: $43.00.$3.49Current price is: $3.49. Add to cart Sale!

Sale!$43.00Original price was: $43.00.$3.49Current price is: $3.49.Add to cartVersion Latest Type Template Released Date July 22, 2020 Quick View - Adobe Photoshop

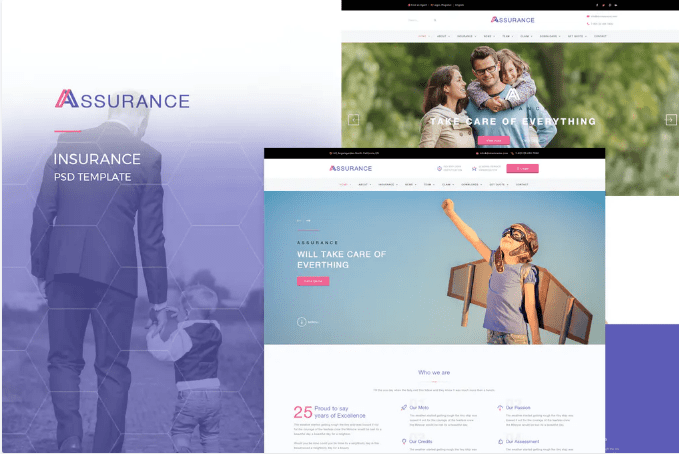

Assurance – Insurance PSD Template

$50.00Original price was: $50.00.$3.49Current price is: $3.49. Add to cart Sale!

Sale!$50.00Original price was: $50.00.$3.49Current price is: $3.49.Add to cartVersion Latest Type Template Released Date July 24, 2020 Quick View - Adobe Photoshop

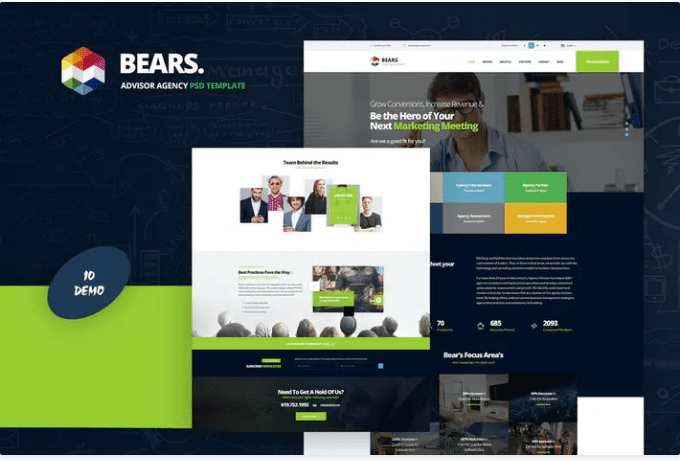

Bear’s – Advisor Agency PSD Template

$50.00Original price was: $50.00.$3.49Current price is: $3.49. Add to cart Sale!

Sale!$50.00Original price was: $50.00.$3.49Current price is: $3.49.Add to cartVersion Latest Type Template Released Date July 25, 2020 Quick View - Adobe Photoshop

Bear’s – Insurance PSD Template

$50.00Original price was: $50.00.$3.49Current price is: $3.49. Add to cart Sale!

Sale!$50.00Original price was: $50.00.$3.49Current price is: $3.49.Add to cartVersion Latest Type Template Released Date July 25, 2020 Quick View - Adobe Photoshop

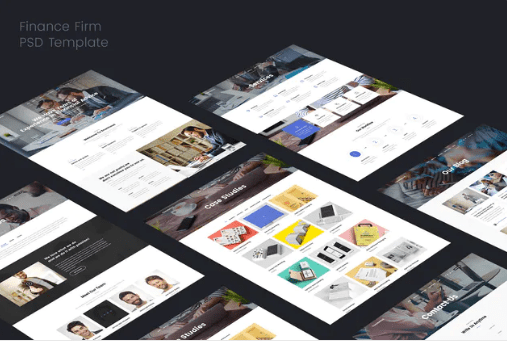

Finance Firms PSD Template

$49.00Original price was: $49.00.$3.89Current price is: $3.89. Add to cart Sale!

Sale!$49.00Original price was: $49.00.$3.89Current price is: $3.89.Add to cartVersion Latest Type Template Released Date July 25, 2020 Quick View - Adobe Photoshop

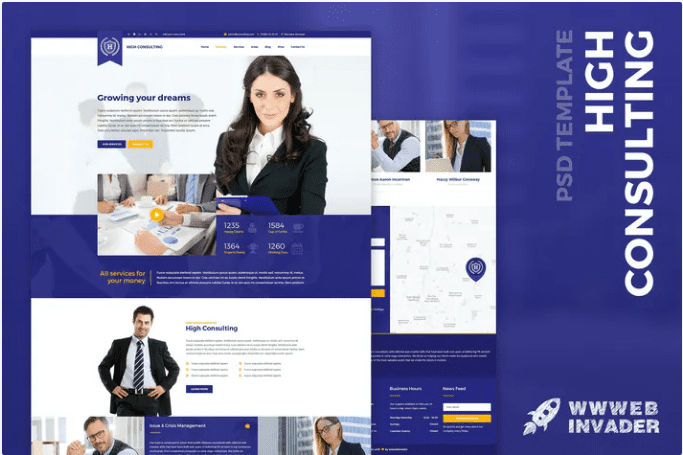

High Consulting – Business & Finance PSD Template

$49.00Original price was: $49.00.$3.89Current price is: $3.89. Add to cart Sale!

Sale!$49.00Original price was: $49.00.$3.89Current price is: $3.89.Add to cartVersion Latest Type Template Released Date July 25, 2020 Quick View - Adobe Photoshop

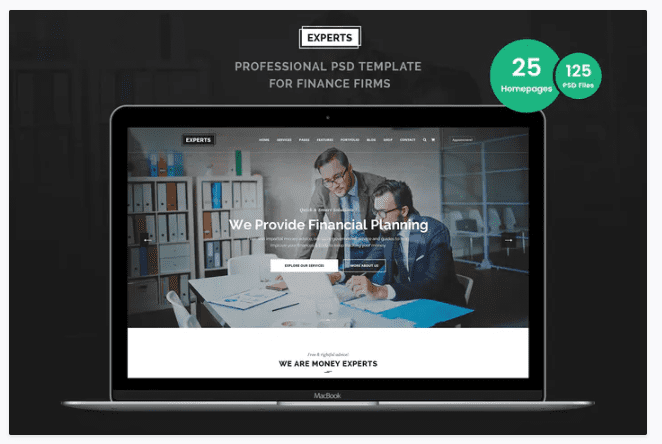

Experts Business and Finance PSD Template

$49.00Original price was: $49.00.$3.89Current price is: $3.89. Add to cart Sale!

Sale!$49.00Original price was: $49.00.$3.89Current price is: $3.89.Add to cartVersion Latest Type Template Released Date July 25, 2020 Quick View - Agency

Finantax – Business and Finance Corporate PSD Template

$12.00Original price was: $12.00.$3.99Current price is: $3.99. Add to cart Sale!

Sale!$12.00Original price was: $12.00.$3.99Current price is: $3.99.Add to cartVersion Latest Type Theme Released Date June 15, 2020 Quick View - Business

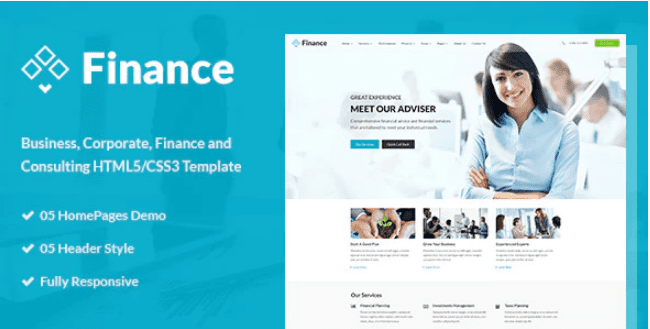

Finance – Business & Financial HTML5 Template

$22.00Original price was: $22.00.$3.99Current price is: $3.99. Add to cart Sale!

Sale!$22.00Original price was: $22.00.$3.99Current price is: $3.99.Add to cartVersion Latest Type Theme Released Date June 15, 2020 Quick View

Shopping Cart