- Computer

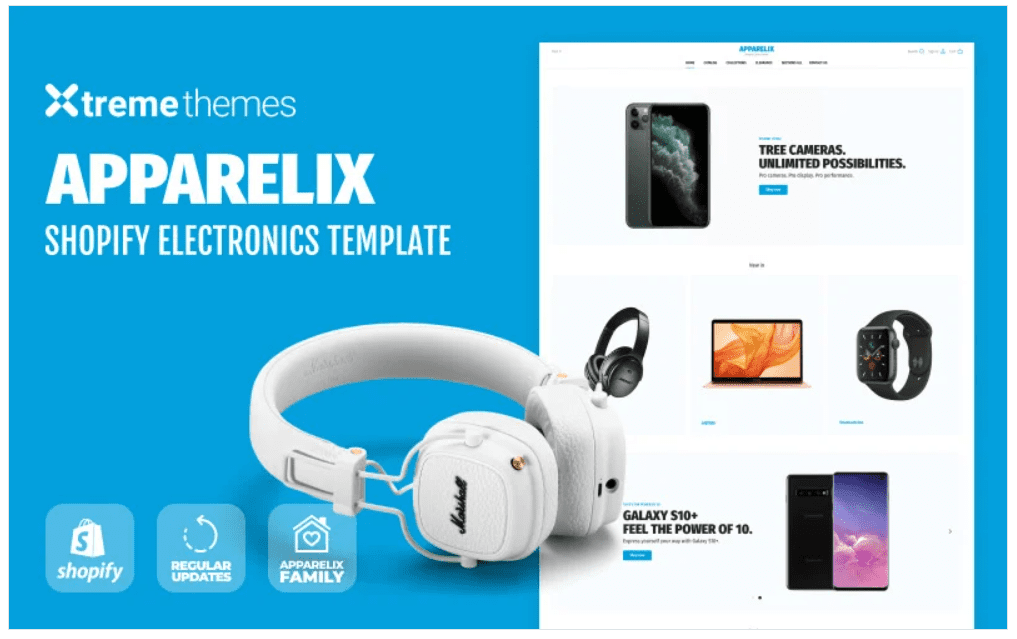

Electronics Shop on Shopify – Apparelix Shopify Theme

$119.00Original price was: $119.00.$4.99Current price is: $4.99. Add to cart Sale!

Sale!$119.00Original price was: $119.00.$4.99Current price is: $4.99.Add to cartVersion Latest Developer Name Templatemonster Type Theme Demo Link https://www.templatemonster.com/shopify-themes/electronics-shop-on-shopify-apparelix-shopify-theme-94005.html Released Date September 25, 2020 Licence Type GPL Quick View - Creative

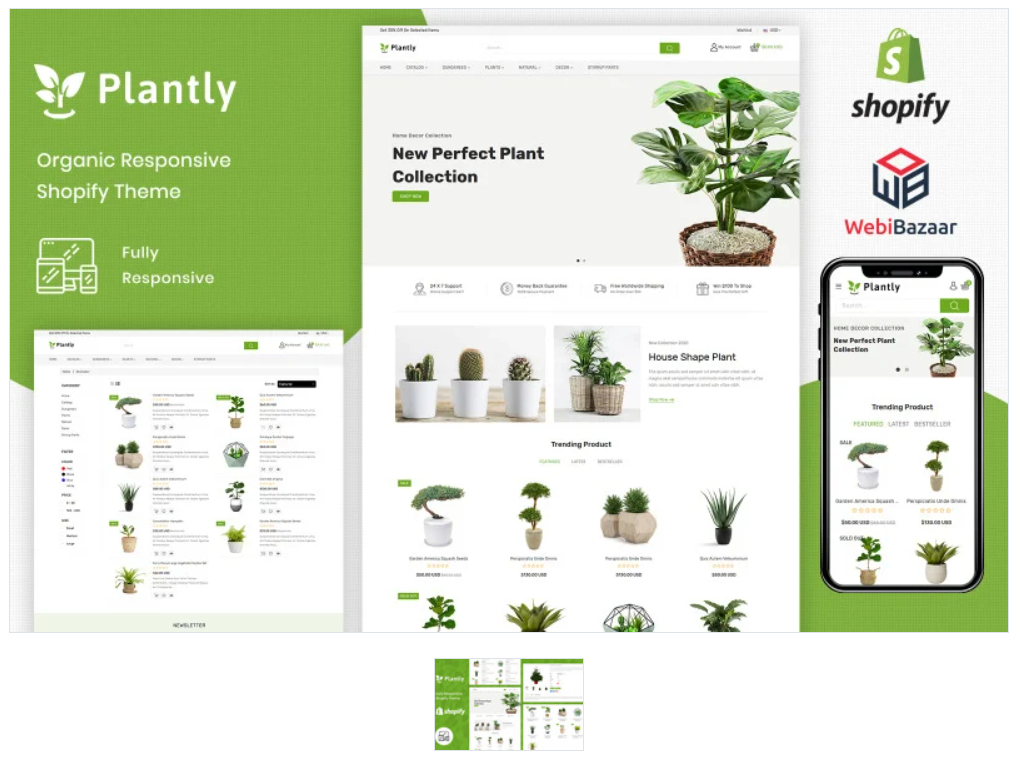

Plantly – Gardan Furniture Responsive Shopify Template Shopify Theme

$139.00Original price was: $139.00.$4.99Current price is: $4.99. Add to cart Sale!

Sale!$139.00Original price was: $139.00.$4.99Current price is: $4.99.Add to cartVersion Latest Developer Name Templatemonster Type Theme Demo Link https://www.templatemonster.com/shopify-themes/plantly-gardan-furniture-responsive-shopify-template-shopify-theme-102227.html Released Date September 18, 2020 Licence Type GPL Quick View - Business Service

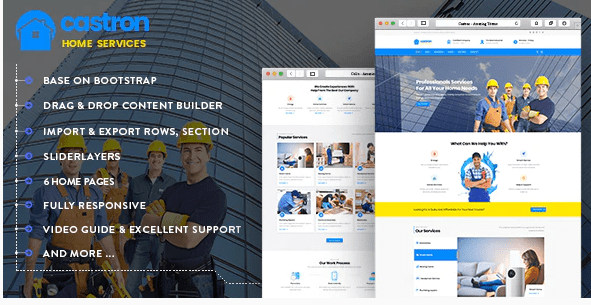

Castron – Home Maintenance, Repair and Improvement Services Drupal 8.8 Theme

$43.00Original price was: $43.00.$4.59Current price is: $4.59. Add to cart Sale!

Sale!$43.00Original price was: $43.00.$4.59Current price is: $4.59.Add to cartVersion Latest Developer Name Themeforest Type Theme Demo Link https://themeforest.net/item/castron-home-maintenance-repair-and-improvement-services-drupal-8-theme/22448918 Released Date April 17, 2020 Licence Type GPL Quick View - Company

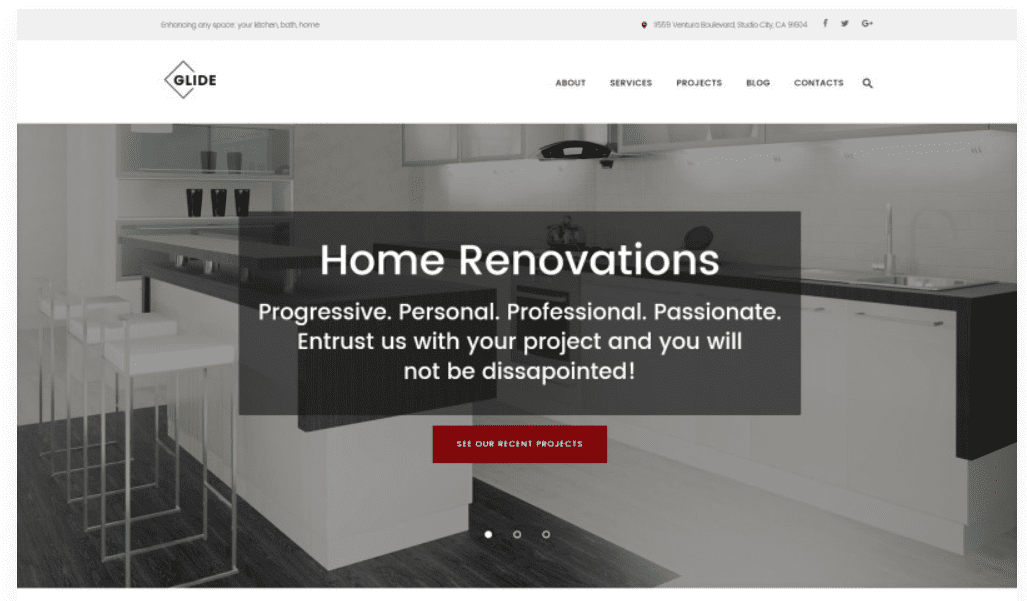

Glide – Home, Bath and Kitchen Renovation Company WordPress Theme

$75.00Original price was: $75.00.$4.99Current price is: $4.99. Add to cart Sale!

Sale!$75.00Original price was: $75.00.$4.99Current price is: $4.99.Add to cartVersion Latest Type Theme Released Date June 1, 2020 Quick View - Business

Loazzne – Vue Nuxt Heating & Air Conditioning Services Template

$16.00Original price was: $16.00.$3.99Current price is: $3.99. Add to cart Sale!

Sale!$16.00Original price was: $16.00.$3.99Current price is: $3.99.Add to cartVersion Latest Type Theme Released Date June 26, 2020 Quick View - Creative

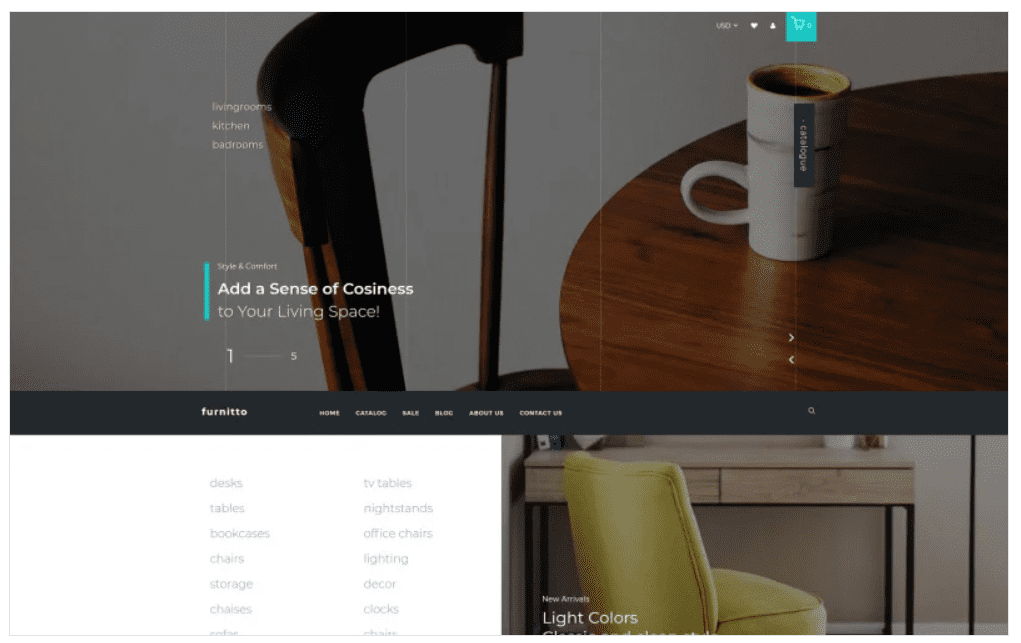

Furnitto – Furniture Store Shopify Theme

$139.00Original price was: $139.00.$4.99Current price is: $4.99. Add to cart Sale!

Sale!$139.00Original price was: $139.00.$4.99Current price is: $4.99.Add to cartVersion Latest Developer Name Templatemonster Type Theme Demo Link https://www.templatemonster.com/shopify-themes/furnitto-furniture-store-shopify-theme-65766.html Released Date September 25, 2020 Licence Type GPL Quick View - Company

Garden Design Responsive Shopify Theme

$139.00Original price was: $139.00.$4.99Current price is: $4.99. Add to cart Sale!

Sale!$139.00Original price was: $139.00.$4.99Current price is: $4.99.Add to cartVersion Latest Developer Name Templatemonster Type Theme Demo Link https://www.templatemonster.com/shopify-themes/garden-design-responsive-shopify-theme-64035.html Released Date September 25, 2020 Licence Type GPL Quick View - Art Culture

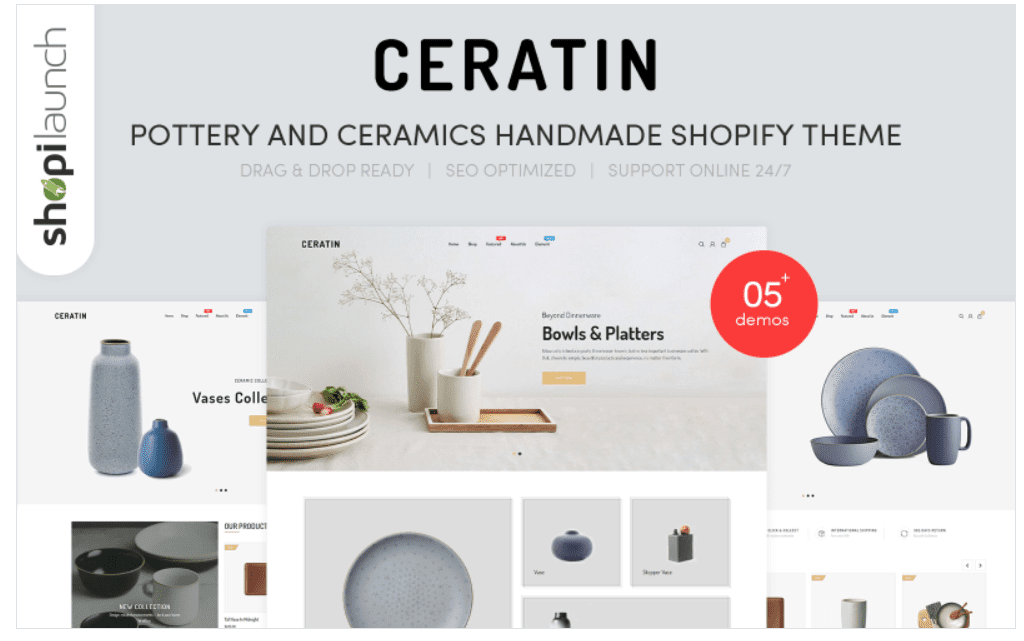

Ceratin – Pottery and Ceramics Handmade Shopify Theme

$118.00Original price was: $118.00.$4.99Current price is: $4.99. Add to cart Sale!

Sale!$118.00Original price was: $118.00.$4.99Current price is: $4.99.Add to cartVersion Latest Developer Name Templatemonster Type Theme Demo Link https://www.templatemonster.com/shopify-themes/ceratin-pottery-and-ceramics-handmade-shopify-theme-94973.html Released Date September 24, 2020 Licence Type GPL Quick View - Apps

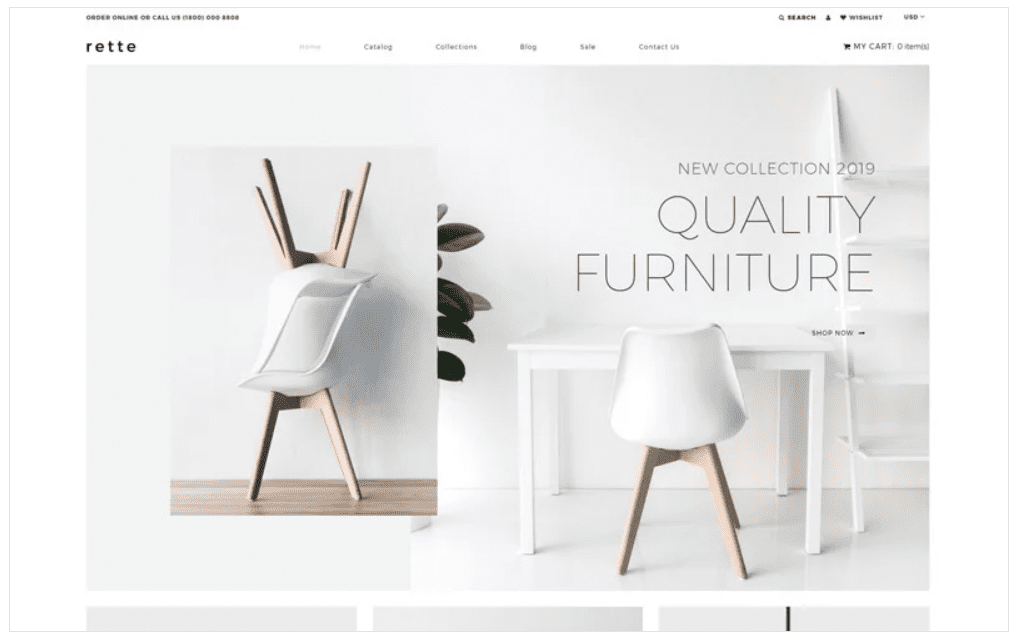

rette – Furniture Multipage Minimalistic Shopify Theme

$139.00Original price was: $139.00.$4.99Current price is: $4.99. Add to cart Sale!

Sale!$139.00Original price was: $139.00.$4.99Current price is: $4.99.Add to cartVersion Latest Developer Name Templatemonster Type Theme Demo Link https://www.templatemonster.com/shopify-themes/81892.html Released Date September 23, 2020 Licence Type GPL Quick View - Creative

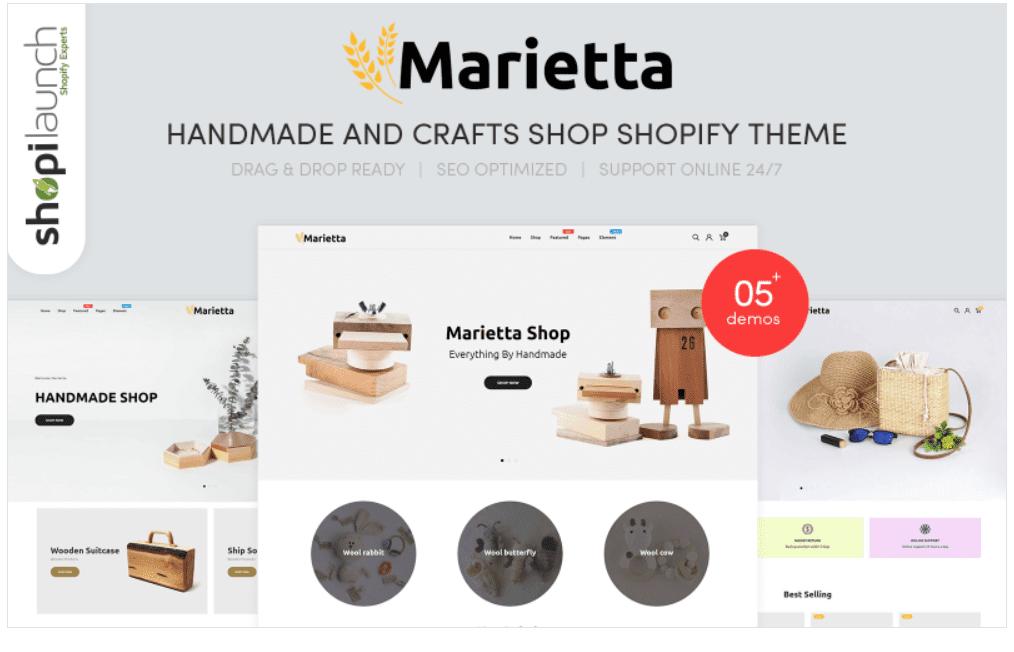

Marietta – Handmade & Crafts Shopify Theme

$118.00Original price was: $118.00.$4.99Current price is: $4.99. Add to cart Sale!

Sale!$118.00Original price was: $118.00.$4.99Current price is: $4.99.Add to cartVersion Latest Developer Name Templatemonster Type Theme Demo Link https://www.templatemonster.com/shopify-themes/marietta-handmade-crafts-shopify-theme-100699.html Released Date September 16, 2020 Licence Type GPL Quick View - Action

Hampton | Home Design and House Renovation WP Theme 1.1.6

$59.00Original price was: $59.00.$4.25Current price is: $4.25. Add to cart Sale!

Sale!$59.00Original price was: $59.00.$4.25Current price is: $4.25.Add to cartVersion 1.1.6 Developer Name Themeforest Type Theme Demo Link https://themeforest.net/item/hampton-home-design-and-house-renovation/19217437 Released Date December 28, 2019 Licence Type GPL .tab-editor-container.ywtm_content_tab table td {padding: 6px 16px;border: 1px solid #e4e4e4;}

Quick View - Business Service

Business Hours for WPBakery

$59.00Original price was: $59.00.$4.25Current price is: $4.25. Add to cart Sale!

Sale!$59.00Original price was: $59.00.$4.25Current price is: $4.25.Add to cartVersion Latest Developer Name Codecanyon Type Theme Demo Link https://codecanyon.net/item/business-hours-for-wpbakery-worker-addon/25384278 Released Date February 8, 2020 Licence Type GPL Quick View - Fashion Beauty

Breeze — Responsive Magento Theme

$89.00Original price was: $89.00.$4.99Current price is: $4.99. Add to cart Sale!

Sale!$89.00Original price was: $89.00.$4.99Current price is: $4.99.Add to cartVersion Latest Developer Name Themeforest Type Theme Demo Link https://themeforest.net/item/breeze-responsive-magento-theme/4119267 Released Date April 20, 2020 Licence Type GPL Quick View - Customize

Homes Realestate unbounce Landing Page

$18.00Original price was: $18.00.$3.85Current price is: $3.85. Add to cart Sale!

Sale!$18.00Original price was: $18.00.$3.85Current price is: $3.85.Add to cartVersion Latest Developer Name Themeforest Type Theme Demo Link https://themeforest.net/item/homes-realestate-unbounce-landing-page/11025899 Released Date April 26, 2020 Licence Type GPL Quick View - Blog

Hasara House – Real Estate Responsive WordPress Theme 1.2.0

$59.00Original price was: $59.00.$4.25Current price is: $4.25. Add to cart Sale!

Sale!$59.00Original price was: $59.00.$4.25Current price is: $4.25.Add to cartVersion 1.2.0 Developer Name Themeforest Type Theme Demo Link https://themeforest.net/item/hasara-house-real-estate-responsive-wordpress-theme/21049154 Released Date May 29, 2020 Licence Type GPL Quick View

Shopping Cart