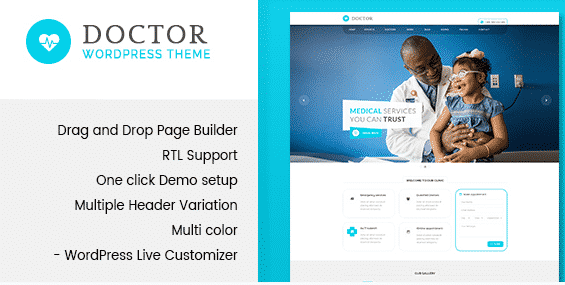

- Doctor

Doctor – Medical & Health WordPress Theme 1.3.2

$59.00Original price was: $59.00.$4.25Current price is: $4.25. Add to cart Sale!

Sale!$59.00Original price was: $59.00.$4.25Current price is: $4.25.Add to cartVersion 1.3.2 Type Theme Released Date September 29, 2018 Quick View - Blog

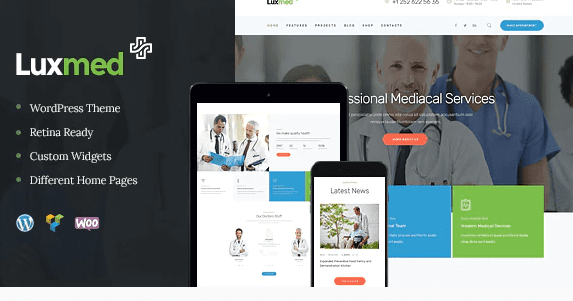

LuxMed | Medicine & Healthcare WordPress Theme 1.2.1

$59.00Original price was: $59.00.$4.59Current price is: $4.59. Add to cart Sale!

Sale!$59.00Original price was: $59.00.$4.59Current price is: $4.59.Add to cartVersion 1.2.1 Developer Name Themeforest Type Theme Demo Link https://themeforest.net/item/luxmed-medicine-healthcare-wp-theme/20081718 Released Date July 19, 2019 Licence Type GPL Quick View - Blog

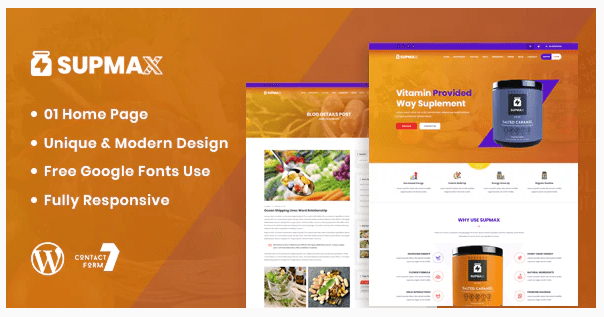

Supmax – Health & Supplement WordPress Theme

$59.00Original price was: $59.00.$4.25Current price is: $4.25. Add to cart Sale!

Sale!$59.00Original price was: $59.00.$4.25Current price is: $4.25.Add to cartVersion Latest Developer Name Themeforest Type Theme Demo Link https://themeforest.net/item/supmax-health-supplement-wordpress-theme/25751445 Released Date April 8, 2020 Licence Type GPL Quick View - Health

Medici – Hospital & Health Services Template Kit

$59.00Original price was: $59.00.$3.99Current price is: $3.99. Add to cart Sale!

Sale!$59.00Original price was: $59.00.$3.99Current price is: $3.99.Add to cartVersion Latest Developer Name Themeforst Type Theme Demo Link https://themeforest.net/item/medici-hospital-health-services-template-kit/26195659 Released Date June 12, 2020 Licence Type GPL Quick View - Business

Newborn – Pregnancy Support Center WordPress Theme

$89.00Original price was: $89.00.$4.65Current price is: $4.65. Add to cart Sale!

Sale!$89.00Original price was: $89.00.$4.65Current price is: $4.65.Add to cartVersion 1.0 Type Theme Released Date July 13, 2020 Quick View - Business

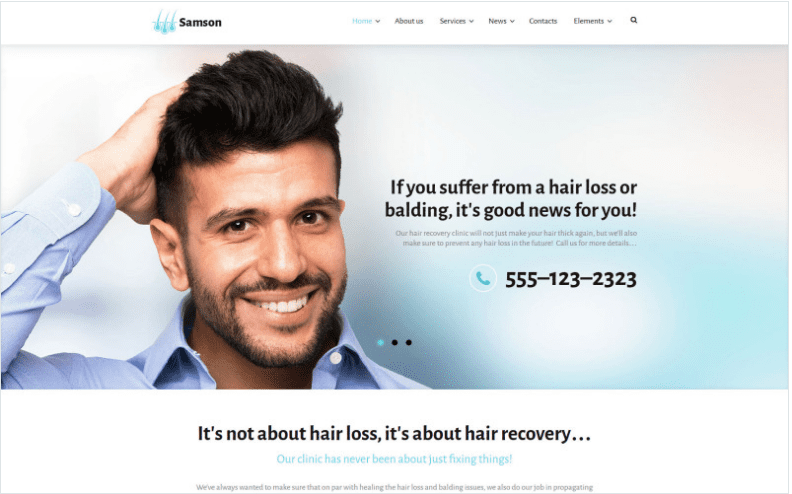

Samson – Hair Recovery Clinic WordPress Theme

$89.00Original price was: $89.00.$4.65Current price is: $4.65. Add to cart Sale!

Sale!$89.00Original price was: $89.00.$4.65Current price is: $4.65.Add to cartVersion 1.0 Developer Name Templatemonster Type Theme Demo Link https://www.templatemonster.com/wordpress-themes/samson-wordpress-theme-59002.html Released Date July 14, 2020 Licence Type GPL Quick View - Health

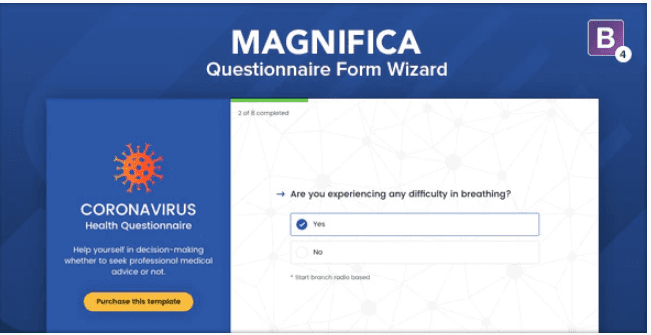

Magnifica – Coronavirus Questionnaire Form Wizard

$19.00Original price was: $19.00.$3.99Current price is: $3.99. Add to cart Sale!

Sale!$19.00Original price was: $19.00.$3.99Current price is: $3.99.Add to cartVersion Latest Type Theme Released Date June 18, 2020 Quick View - Care

Relish – Spa Salon HTML Template

$27.00Original price was: $27.00.$3.99Current price is: $3.99. Add to cart Sale!

Sale!$27.00Original price was: $27.00.$3.99Current price is: $3.99.Add to cartVersion Latest Type Theme Released Date June 25, 2020 Quick View - Beauty

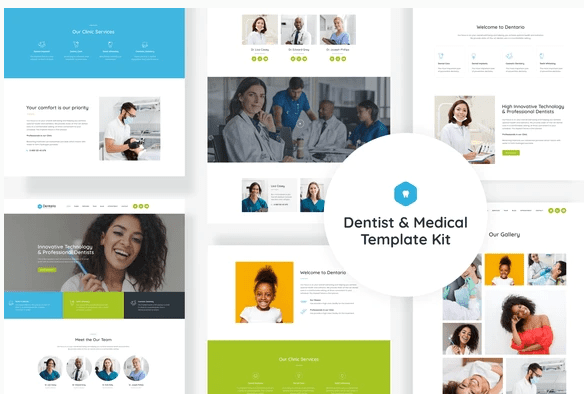

Dentario – Dentist & Medical Elementor Template Kit

$29.00Original price was: $29.00.$3.99Current price is: $3.99. Add to cart Sale!

Sale!$29.00Original price was: $29.00.$3.99Current price is: $3.99.Add to cartVersion Latest Developer Name Envato Type Theme Demo Link https://themeforest.net/item/dentario-dentist-medical-template-kit/26311805 Released Date September 12, 2020 Licence Type GPL Quick View - Beauty

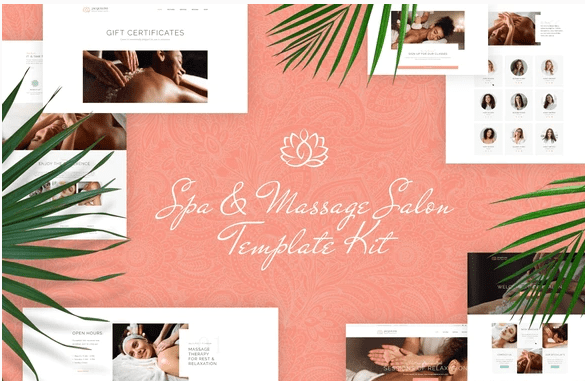

Jacqueline – Spa & Massage Salon Elementor Template Kit

$29.00Original price was: $29.00.$3.99Current price is: $3.99. Add to cart Sale!

Sale!$29.00Original price was: $29.00.$3.99Current price is: $3.99.Add to cartVersion Latest Type Theme Released Date September 12, 2020 Quick View - Booking

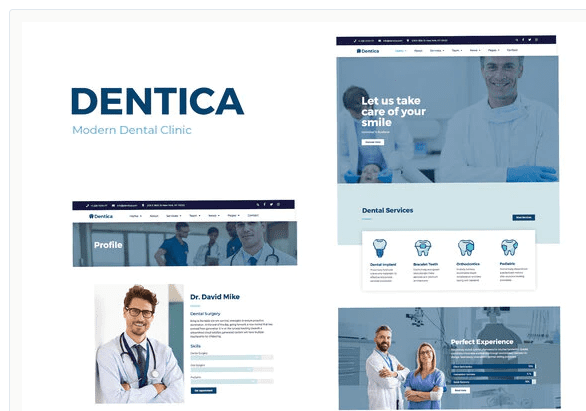

Dentica – Dental Clinic Elementor Template Kit

$19.00Original price was: $19.00.$3.99Current price is: $3.99. Add to cart Sale!

Sale!$19.00Original price was: $19.00.$3.99Current price is: $3.99.Add to cartVersion Latest Type Theme Released Date September 11, 2020 Quick View - Clinic

Medikor – Medical Healthcare Elementor Template Kit

$10.00Original price was: $10.00.$3.99Current price is: $3.99. Add to cart Sale!

Sale!$10.00Original price was: $10.00.$3.99Current price is: $3.99.Add to cartVersion Latest Type Theme Released Date September 11, 2020 Quick View - Creative

Kardone – Sports Equipment Online Store Template Shopify Theme

$139.00Original price was: $139.00.$4.99Current price is: $4.99. Add to cart Sale!

Sale!$139.00Original price was: $139.00.$4.99Current price is: $4.99.Add to cartVersion Latest Developer Name Templatemonster Type Theme Demo Link https://www.templatemonster.com/shopify-themes/kardone-sports-equipment-online-store-template-shopify-theme-99978.html Released Date September 14, 2020 Licence Type GPL Quick View - Care

KarDone Medicine Online Store Template Shopify Theme

$139.00Original price was: $139.00.$4.99Current price is: $4.99. Add to cart Sale!

Sale!$139.00Original price was: $139.00.$4.99Current price is: $4.99.Add to cartVersion Latest Developer Name Templatemonster Type Theme Demo Link https://www.templatemonster.com/shopify-themes/kardone-medicine-online-store-template-shopify-theme-99455.html Released Date September 14, 2020 Licence Type GPL Quick View - Business

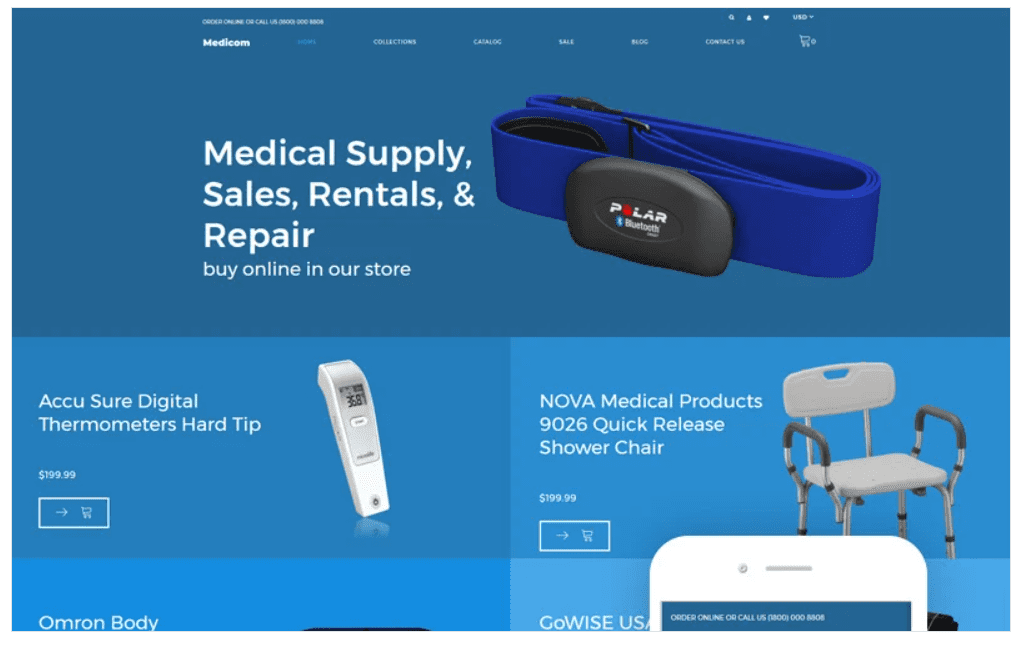

Medicom – Medical Equipment Multipage Clean Shopify Theme

$139.00Original price was: $139.00.$4.99Current price is: $4.99. Add to cart Sale!

Sale!$139.00Original price was: $139.00.$4.99Current price is: $4.99.Add to cartVersion Latest Developer Name Templatemonster Type Theme Demo Link https://www.templatemonster.com/shopify-themes/medicom-medical-equipment-multipage-clean-shopify-theme-79483.html Released Date September 16, 2020 Licence Type GPL Quick View

Shopping Cart